Discover Top Credit Unions in Wyoming: Your Guide to Financial Services

Discover Top Credit Unions in Wyoming: Your Guide to Financial Services

Blog Article

Elevate Your Banking Experience With Credit Report Unions

Credit history unions, with their focus on member-centric solutions and community involvement, provide an engaging option to conventional banking. By prioritizing private requirements and cultivating a feeling of belonging within their subscription base, credit scores unions have actually sculpted out a particular niche that reverberates with those seeking a more customized strategy to managing their financial resources.

Advantages of Lending Institution

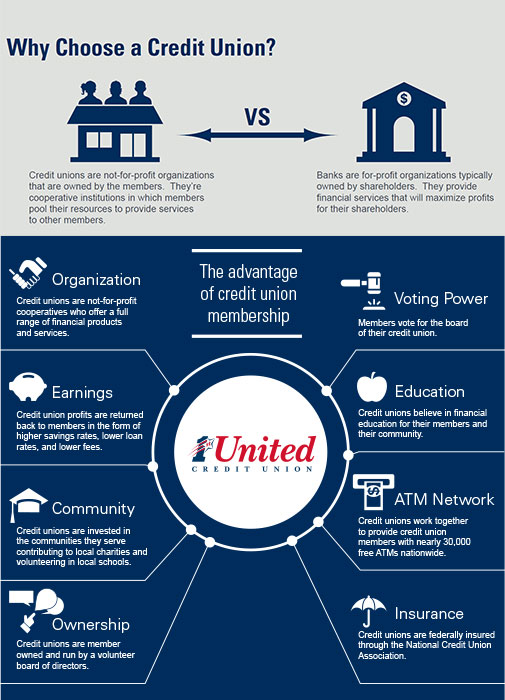

Providing a variety of economic services tailored to the demands of their participants, credit report unions offer various advantages that set them apart from traditional financial institutions. One key benefit of lending institution is their concentrate on community involvement and participant complete satisfaction. Unlike banks, credit report unions are not-for-profit organizations owned by their participants, which usually leads to decrease charges and much better rate of interest on financial savings accounts, lendings, and bank card. Additionally, credit rating unions are understood for their individualized customer care, with team members taking the time to understand the one-of-a-kind monetary objectives and difficulties of each member.

An additional benefit of debt unions is their democratic framework, where each participant has an equal enact choosing the board of directors. This makes certain that decisions are made with the very best interests of the participants in mind, as opposed to concentrating only on optimizing profits. Credit rating unions commonly offer financial education and learning and therapy to aid participants boost their financial proficiency and make educated decisions regarding their cash. On the whole, the member-focused approach of debt unions establishes them apart as establishments that focus on the wellness of their neighborhood.

Membership Requirements

Some credit report unions might serve individuals that function or live in a particular geographic area, while others might be connected with specific business, unions, or organizations. In addition, household members of current credit union members are commonly qualified to join as well.

To end up being a participant of a cooperative credit union, people are usually required to open an account and preserve a minimum deposit as specified by the institution. In many cases, there may be one-time membership charges or continuous subscription fees. As soon as the subscription standards are met, people can enjoy the advantages of belonging to a cooperative credit union, including accessibility to personalized financial services, affordable rates of interest, and an emphasis on participant satisfaction.

Personalized Financial Providers

Personalized monetary services customized to private requirements and preferences are a hallmark of lending institution' dedication to member complete satisfaction. Unlike conventional financial institutions that usually supply one-size-fits-all options, credit score unions take a much more customized approach to handling their members' finances. By recognizing the distinct goals and circumstances of each participant, cooperative credit union can offer customized suggestions on savings, investments, car loans, and other economic products.

Credit rating unions focus on developing strong connections with their participants, which enables them to supply customized solutions that exceed simply the numbers. Whether someone is saving for a specific goal, preparing for retirement, or aiming to improve their credit rating rating, cooperative credit union can create personalized economic plans to assist participants achieve their goals.

In addition, lending institution usually offer reduced charges and competitive rates of interest on car loans and financial savings accounts, further improving the customized economic services they provide. Cheyenne Credit Unions. By focusing on individual requirements and supplying customized remedies, cooperative credit union set themselves apart as trusted monetary companions committed to aiding members flourish economically

Neighborhood Participation and Assistance

Area interaction is a keystone of lending institution' mission, reflecting their dedication to sustaining local initiatives and cultivating meaningful links. Credit history unions actively participate in community occasions, enroller regional charities, and organize financial literacy programs to enlighten participants and non-members alike. By purchasing the neighborhoods they serve, Credit Unions in Wyoming credit unions not just enhance their connections but additionally add to the overall health of culture.

Supporting tiny services is another means debt unions show their commitment to neighborhood neighborhoods. Through supplying little business loans and economic guidance, credit rating unions aid entrepreneurs grow and promote economic development in the location. This support exceeds just financial help; cooperative credit union frequently provide mentorship and networking chances to help small companies succeed.

In addition, lending institution frequently take part in volunteer job, urging their members and workers to repay via numerous area service activities. Whether it's participating in local clean-up occasions or organizing food drives, credit report unions play an active role in improving the top quality of life for those in requirement. By prioritizing community participation and support, lending institution truly personify the spirit of teamwork and mutual assistance.

Electronic Banking and Mobile Apps

Mobile apps supplied by cooperative credit union even more boost the financial experience by offering added versatility and ease of access. Participants can carry out numerous banking jobs on the go, such as transferring checks by taking a photo, obtaining account notices, and also getting in touch with customer assistance straight with the application. The safety of these mobile apps is a leading priority, with functions like biometric authentication and security methods to protect delicate info. Overall, cooperative credit union' electronic banking and mobile apps encourage members to manage their funds efficiently and safely in today's busy digital world.

Verdict

In verdict, debt unions offer a distinct financial experience that prioritizes neighborhood participation, personalized solution, and member fulfillment. With reduced costs, affordable passion prices, and tailored monetary solutions, credit history unions provide to specific requirements and advertise financial wellness.

Unlike financial institutions, credit report unions are not-for-profit organizations had by their members, which commonly leads to lower charges and far better interest prices on savings accounts, loans, and debt cards. Furthermore, credit unions are understood for their personalized client solution, with team participants taking the time to recognize the special economic objectives and challenges of each member.

Report this page